Digital Asset Investment Products See Massive Inflows, Signaling a Return of Investor Confidence

Bitcoin, the king of cryptocurrencies, is leading the charge with inflows of US$240 million last week.

key takeaways

- Digital asset investment products are seeing a massive influx of capital.

- Bitcoin is leading the charge, with year-to-date inflows of over US$1 billion.

- Ethereum and Solana are also experiencing strong inflows.

- Blockchain equity ETFs are also seeing inflows, indicating broader interest in the blockchain ecosystem.

- The overall sentiment in the digital asset market is turning positive.

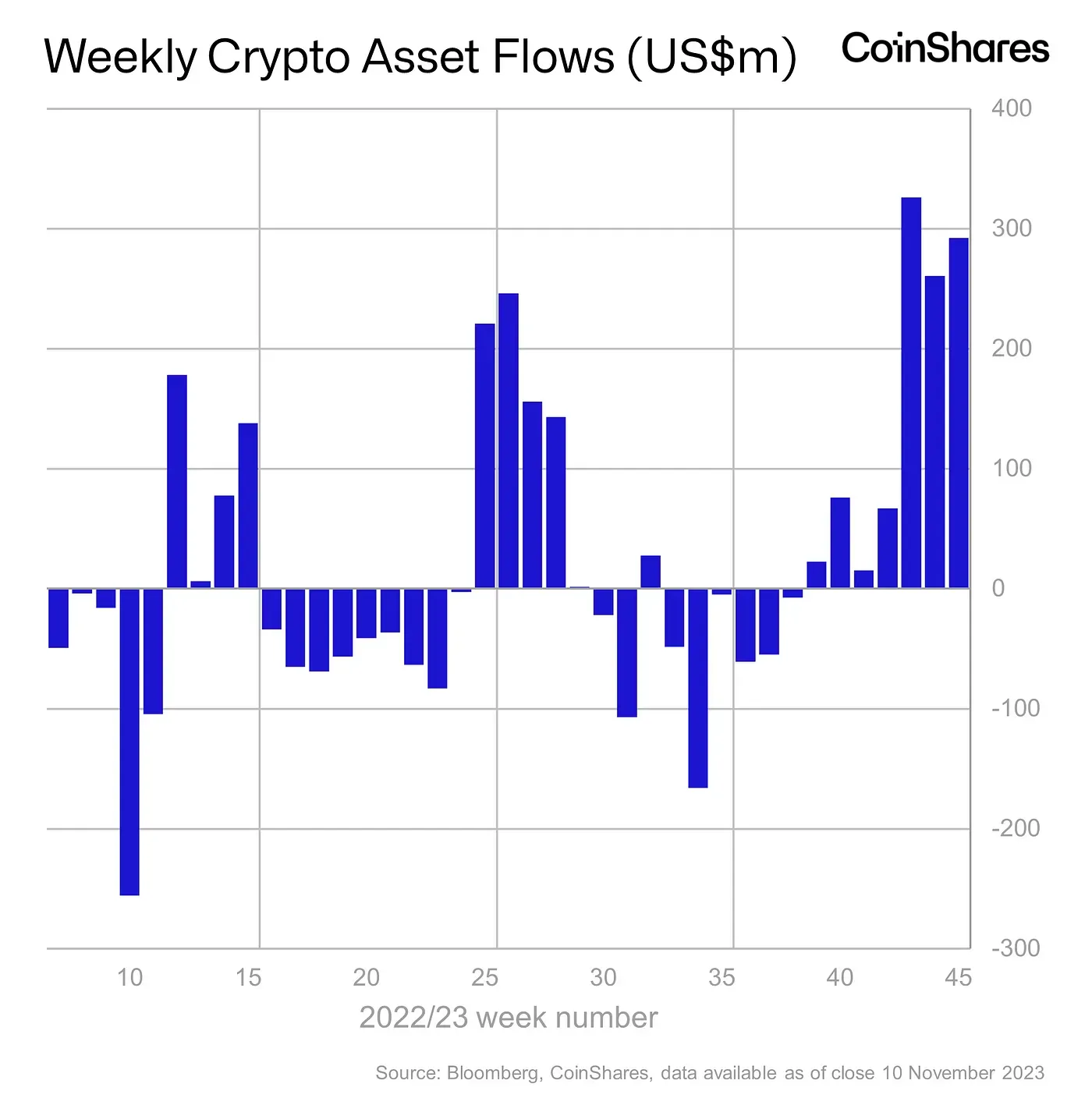

The digital asset market is roaring back, with investment products seeing a staggering US$293 million in inflows last week. This marks the seventh consecutive week of inflows, pushing the total inflow for the year past the US$1 billion mark. This is a remarkable turnaround from the bear market of 2022, and it's a clear sign that investors are regaining confidence in digital assets, according to CoinShares latest report.

Bitcoin, the king of cryptocurrencies, is leading the charge with inflows of US$240 million last week. This brings year-to-date inflows to a whopping US$1.08 billion, indicating that investors are betting on Bitcoin's long-term potential.

Ethereum, the second-largest cryptocurrency, is also seeing a resurgence of interest. Inflows of US$49 million last week were the largest since August 2022, and they suggest that investors are optimistic about Ethereum's future, especially with the recent launch of spot-based ETF listing in the US.

Solana, another popular cryptocurrency, is also enjoying a positive trend. Inflows of US$12 million last week further demonstrate the growing interest in this blockchain platform.

Even blockchain equity ETFs are seeing some love, with inflows of US$14 million, the largest since July 2022. This indicates that investors are not just interested in individual cryptocurrencies but also in the broader blockchain ecosystem.

The overall sentiment in the digital asset market is turning decidedly positive. Investors are pouring money back into digital assets, and they're doing so with renewed enthusiasm. This is a clear sign that the market is on the rebound, and it's exciting to see what the future holds.

Overall, the report is a resounding endorsement for the future of digital assets. The market is rebounding, and investors are regaining confidence. This is a great time to get involved in the digital asset revolution.